Vermont Room And Meals Tax . following are rates for meals and rooms tax in vermont: • 9% on sales of lodging. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. Your august meals and rooms tax return will. vermont meals and rooms tax. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. • 9% on sales of prepared and restaurant meals.

from www.templateroller.com

the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. • 9% on sales of prepared and restaurant meals. • 9% on sales of lodging. following are rates for meals and rooms tax in vermont: any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. vermont meals and rooms tax. Your august meals and rooms tax return will. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting.

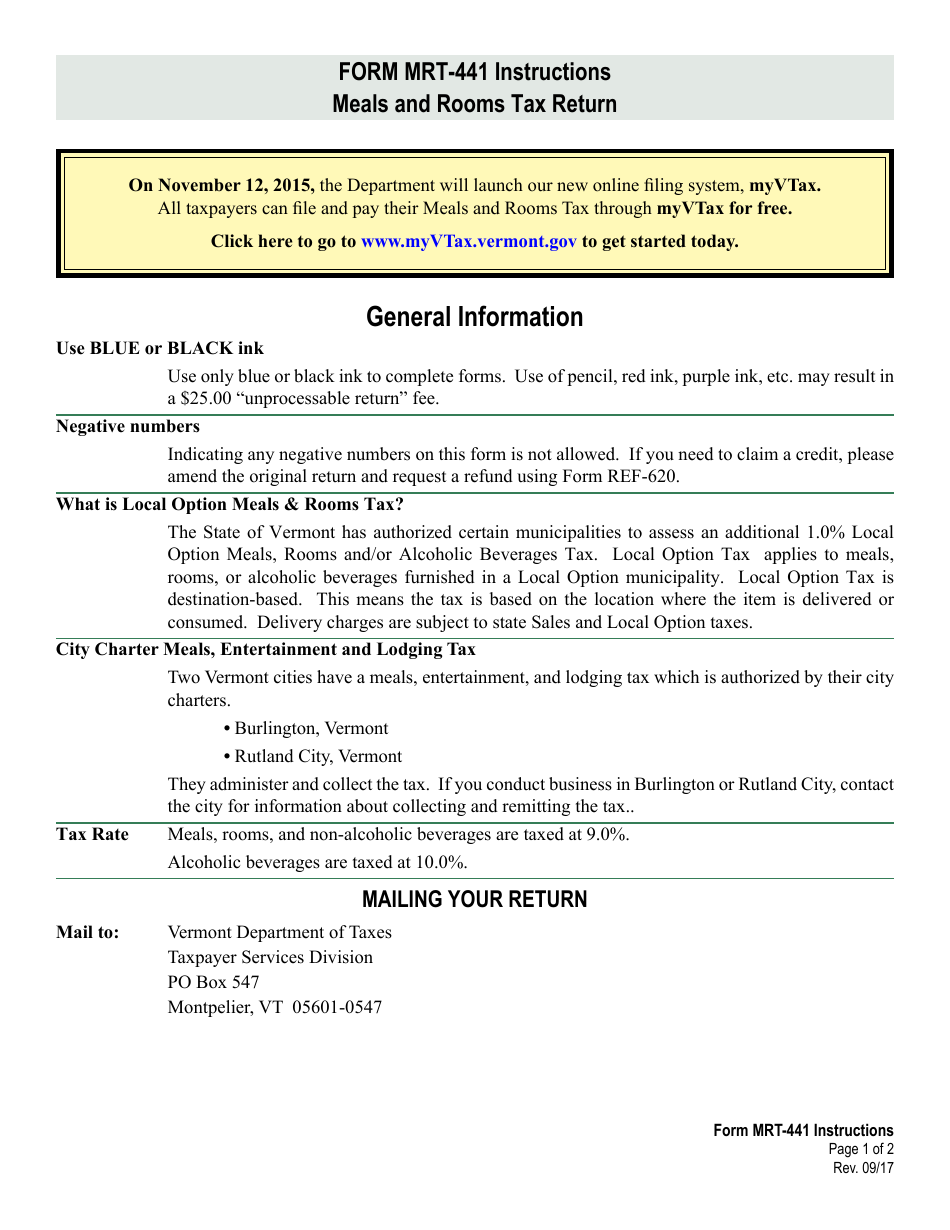

Download Instructions for VT Form MRT441 Meals and Rooms Tax Return

Vermont Room And Meals Tax Your august meals and rooms tax return will. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. vermont meals and rooms tax. • 9% on sales of lodging. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. Your august meals and rooms tax return will. following are rates for meals and rooms tax in vermont: • 9% on sales of prepared and restaurant meals.

From www.templateroller.com

Download Instructions for VT Form MRT441 Meals and Rooms Tax Return Vermont Room And Meals Tax the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. following are rates for meals and rooms tax in vermont: • 9% on sales of lodging. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. any private person, entity, institution, or organization. Vermont Room And Meals Tax.

From www.templateroller.com

Form M3 Fill Out, Sign Online and Download Printable PDF, Vermont Vermont Room And Meals Tax • 9% on sales of lodging. vermont meals and rooms tax. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. any private person, entity, institution, or organization selling meals, serving alcohol, or. Vermont Room And Meals Tax.

From www.taxuni.com

Vermont Meals and Rooms Tax Vermont Room And Meals Tax Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. • 9% on sales of prepared and restaurant meals. Your august meals and rooms tax return will. the vermont meals and rooms tax is paid. Vermont Room And Meals Tax.

From www.templateroller.com

VT Form MRT441 Download Fillable PDF or Fill Online Meals and Rooms Vermont Room And Meals Tax the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. • 9% on sales of lodging. following are rates for meals and rooms tax in vermont: any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the.. Vermont Room And Meals Tax.

From vtdigger.org

Towns consider local taxes on meals, lodging, alcohol and sales VTDigger Vermont Room And Meals Tax • 9% on sales of lodging. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. vermont meals and rooms tax. • 9% on sales of prepared and restaurant meals. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. Your august meals and rooms. Vermont Room And Meals Tax.

From www.templateroller.com

Form REF620 Fill Out, Sign Online and Download Printable PDF Vermont Room And Meals Tax the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. • 9% on sales of lodging. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must. Vermont Room And Meals Tax.

From www.taxuni.com

Vermont Meals and Rooms Tax Vermont Room And Meals Tax vermont meals and rooms tax. • 9% on sales of lodging. following are rates for meals and rooms tax in vermont: any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served. Vermont Room And Meals Tax.

From www.formsbank.com

Fillable Form Dp14 Meals & Rooms Tax Return printable pdf download Vermont Room And Meals Tax Your august meals and rooms tax return will. following are rates for meals and rooms tax in vermont: vermont meals and rooms tax. • 9% on sales of lodging. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. • 9% on sales of prepared and restaurant meals. the vermont meals and rooms tax. Vermont Room And Meals Tax.

From www.templateroller.com

VT Form REF620 Fill Out, Sign Online and Download Fillable PDF Vermont Room And Meals Tax following are rates for meals and rooms tax in vermont: vermont meals and rooms tax. Your august meals and rooms tax return will. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. any private person, entity, institution, or organization selling meals, serving alcohol, or. Vermont Room And Meals Tax.

From www.pdffiller.com

Fillable Online tax vermont Vermont Meals Tax Exemption Certificate Fax Vermont Room And Meals Tax the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. following are rates for meals and rooms tax in vermont: Your august meals and rooms tax. Vermont Room And Meals Tax.

From www.templateroller.com

Download Instructions for VT Form REF620 Application for Refund of Vermont Room And Meals Tax • 9% on sales of lodging. Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. following are rates for meals and rooms tax in vermont: Your august meals and rooms tax return will. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when.. Vermont Room And Meals Tax.

From vtdigger.org

Senate scraps clean water ‘cloud tax,’ looks to increase rooms and Vermont Room And Meals Tax following are rates for meals and rooms tax in vermont: Your august meals and rooms tax return will. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. vermont meals and rooms tax. • 9% on sales of lodging. any private person, entity, institution, or. Vermont Room And Meals Tax.

From www.templateroller.com

Form MRT441 Fill Out, Sign Online and Download Fillable PDF, Vermont Vermont Room And Meals Tax • 9% on sales of lodging. Your august meals and rooms tax return will. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. vermont meals and rooms tax. • 9% on sales of prepared and restaurant meals. any private person, entity, institution, or organization selling. Vermont Room And Meals Tax.

From gravelshea.com

March 24, 2020 Officials Roll Out Changes to Vermont Room and Meals Vermont Room And Meals Tax the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. vermont meals and rooms tax. any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. Any private person, entity, institution, or organization selling meals, serving alcohol,. Vermont Room And Meals Tax.

From www.slideserve.com

PPT TOURISM AND THE ROOMS AND MEALS TAX PowerPoint Presentation, free Vermont Room And Meals Tax any private person, entity, institution, or organization selling meals, serving alcohol, or renting rooms to the public must collect the. • 9% on sales of prepared and restaurant meals. Your august meals and rooms tax return will. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when.. Vermont Room And Meals Tax.

From exozqqmek.blob.core.windows.net

Are Vermont Taxes High at Dorothy Ammons blog Vermont Room And Meals Tax vermont meals and rooms tax. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. • 9% on sales of lodging. • 9% on sales of prepared and restaurant meals. Your august meals and rooms tax return will. any private person, entity, institution, or organization selling. Vermont Room And Meals Tax.

From www.formsbank.com

Fillable Form Mrt441 Meals And Rooms Tax Return printable pdf download Vermont Room And Meals Tax vermont meals and rooms tax. the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. Your august meals and rooms tax return will. following are rates for meals and rooms tax in vermont: • 9% on sales of prepared and restaurant meals. • 9% on sales. Vermont Room And Meals Tax.

From www.templateroller.com

Download Instructions for VT Form MRT441 Meals and Rooms Tax Return Vermont Room And Meals Tax the vermont meals and rooms tax is paid when purchasing meals or alcoholic beverages served in bars and restaurants and when. following are rates for meals and rooms tax in vermont: Any private person, entity, institution, or organization selling meals, serving alcohol, or renting. Your august meals and rooms tax return will. any private person, entity, institution,. Vermont Room And Meals Tax.